Insurance-approved repair status is a key accreditation for automotive workshops, ensuring their proficiency in various car repair services while adhering to industry standards recognized by insurers. To achieve this, businesses must meet specific criteria like advanced repair techniques, quality control systems, staff training, client communication, and adequate facilities. The process involves understanding insurance requirements, submitting detailed applications with supporting documents, and showcasing expertise through past projects. This accreditation offers customers peace of mind and streamlines insurance claims processing.

Looking to restore your property after damage? Achieving insurance-approved repair status is crucial. This guide breaks down the process, from understanding the concept to securing approval. We’ll delve into the eligibility criteria, essential steps in the application process, and key documents required for a seamless journey. By following these insights, you’ll be well-equipped to navigate the path to insured repairs and restoration peace of mind.

- Understanding Insurance-Approved Repair Status

- Eligibility Criteria for Repair Status

- The Application Process and Necessary Documents

Understanding Insurance-Approved Repair Status

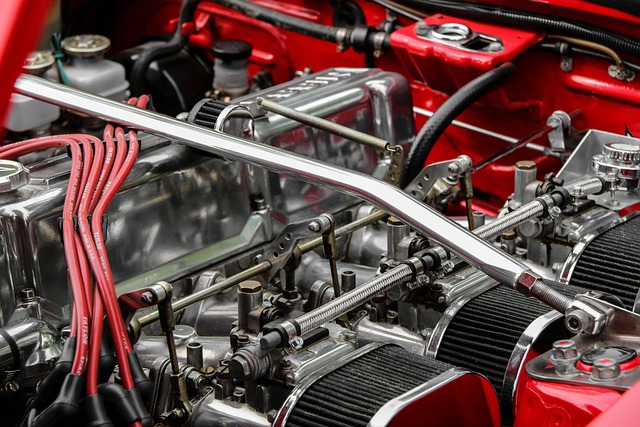

Insurance-approved repair status is a crucial designation for automotive businesses, ensuring that their services meet specific standards recognized by insurance companies. This accreditation is essential for car repair shops aiming to provide high-quality and reliable vehicle bodywork solutions. When a workshop achieves this status, it signifies their capability to handle a wide range of car repair tasks, from minor frame straightening to more complex repairs, all while adhering to strict guidelines.

This approval process involves demonstrating expertise in various aspects of vehicle maintenance, including frame straightening techniques and the latest advancements in car repair services. By attaining this recognition, workshops can offer peace of mind to customers, assuring them that their vehicles will be restored to pre-accident condition by qualified professionals. It also allows for streamlined insurance claims processing, making the overall experience smoother for both the repair shop and policyholders.

Eligibility Criteria for Repair Status

To be eligible for insurance-approved repair status, a business must meet specific criteria set by insurance companies and industry standards. Firstly, the shop needs to demonstrate expertise and adherence to best practices in various types of repairs, including paintless dent repair, auto glass replacement, and collision repair. This involves staying up-to-date with the latest technologies and techniques in the field.

Additionally, a robust quality control system is essential. The insurance company will assess the shop’s ability to consistently deliver high-quality work, ensuring customer satisfaction and safety. This includes proper training of staff, adherence to industry standards, and effective communication with clients regarding the repair process. Proper facilities, equipment, and licensing are also non-negotiable requirements for any collision repair shop aiming for insurance-approved status.

The Application Process and Necessary Documents

Applying for insurance-approved repair status involves a structured process designed to ensure quality and accountability. The first step is to familiarize yourself with the requirements set by your insurance company or the relevant regulatory authority. This includes understanding the criteria for becoming an approved repairer, which often entails meeting specific standards of training, equipment, and facilities.

Necessary documents play a crucial role in this process. You’ll need to prepare detailed applications forms, providing information about your business, including its history, staff qualifications, and insurance coverage. Additionally, supporting documents such as licenses, certifications from relevant automotive bodies, and references from previous clients or other approved repairers will be required. For car damage repair or collision repair shop seeking approval, demonstrating expertise in vehicle body repair through past projects and case studies can significantly strengthen your application.

Obtaining insurance-approved repair status is a significant step in ensuring your business can provide quality, covered repairs. By understanding the eligibility criteria and navigating the application process with the necessary documents, you empower yourself to offer peace of mind to customers and strengthen your reputation in the industry. Remember, an insurance-approved repair status isn’t just a designation; it’s a commitment to excellence and customer satisfaction.