Understanding and adhering to insurance-approved repair requirements is essential for maintaining active insurer status and seamless claims handling. Insurers dictate specific guidelines focusing on safety, structural integrity, cosmetic enhancements, and restoring pre-accident conditions. Reputable collision repair services specializing in insurance-approved repairs ensure efficient claims processing, adherence to industry standards, and optimal vehicle restoration. Regular communication with insurers about policy updates, prompt addressing of repair needs, and timely documentation facilitate compliance, simplifying the claims process and preventing gaps in coverage.

Staying on top of your insurer status is crucial for seamless coverage and peace of mind. This article uncovers seven powerful secrets to keep your insurer status active, ensuring compliance with insurance-approved repair requirements. Learn effective strategies to navigate potential pitfalls and avoid common mistakes that could jeopardize your policy. Discover the key steps to maintaining a robust relationship with your insurer and protect your assets effectively.

- Understanding Insurance-Approved Repair Requirements

- Strategies to Maintain Active Insurer Status

- Common Pitfalls and How to Avoid Them

Understanding Insurance-Approved Repair Requirements

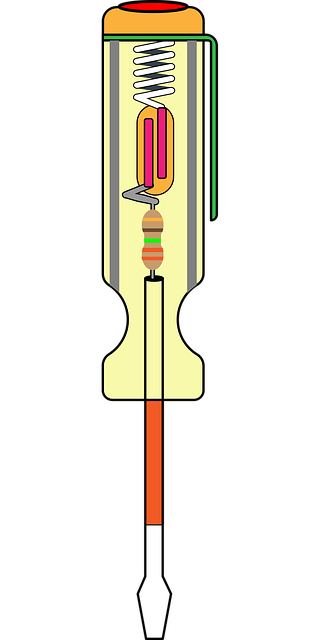

When it comes to keeping your insurer status active, understanding insurance-approved repair requirements is paramount. Insurers have specific guidelines for vehicle body repair, ensuring that all repairs meet their standards for safety and quality. These regulations cover everything from structural integrity to cosmetic enhancements, with a particular focus on ensuring that the car’s performance and safety features are restored to pre-accident condition.

Knowing what constitutes an insurance-approved repair is crucial when dealing with car damage repair or vehicle body repair. This includes adhering to the recommended techniques and materials specified by the insurer. For instance, for car dent repair, using approved methods like paintless dent repair (PDR) can expedite the process while maintaining the original finish. By following these guidelines, policyholders can ensure their claims are processed smoothly and that their vehicles are restored to optimal condition, thereby keeping their insurance status in good standing.

Strategies to Maintain Active Insurer Status

Keeping your insurer status active is paramount to ensuring uninterrupted coverage and claims support. It involves a combination of proactive maintenance and strategic adherence to insurance guidelines. Regular interaction with your insurance provider is key; stay informed about policy updates and necessary requirements for claim approvals. One effective strategy is to engage reputable collision repair services that specialize in insurance-approved repairs. These professionals not only ensure your vehicle is restored to pre-accident condition but also follow industry standards and best practices, making the claims process smoother.

Additionally, timely documentation of repairs, including detailed records of parts used and labor costs, is vital. This documentation serves as evidence during claims settlements, demonstrating compliance with insurance guidelines. Regularly checking with your insurer about specific requirements for different types of damage further ensures you’re meeting all necessary criteria. Engaging a reliable collision repair center or car bodywork services provider who understands these nuances can significantly simplify the process, keeping your insurer status active and secure.

Common Pitfalls and How to Avoid Them

Many policyholders often find themselves at risk of letting their insurance coverage lapse due to unforeseen circumstances or a lack of understanding of the requirements. It’s crucial to be aware of these common pitfalls and take proactive measures to maintain an active insurer status. One frequent trap is neglecting routine maintenance and repairs, especially for vehicles. Insurance companies require policyholders to uphold their end by ensuring any damage is addressed promptly through insurance-approved repair services. Ignoring minor issues can lead to more significant problems down the line, resulting in a lag in coverage.

To avoid these pitfalls, stay vigilant about scheduling regular servicing and promptly addressing any auto collision repair needs. Reputable collision centers offer specialized auto body services that meet insurance standards, ensuring your vehicle is restored to its pre-accident condition. By being proactive and utilizing these resources, policyholders can maintain their active insurer status, preventing potential gaps in coverage and the associated financial burdens.

Maintaining an active insurer status is crucial for ensuring continuous protection and coverage. By understanding the requirements for insurance-approved repairs, implementing effective strategies, and steering clear of common pitfalls, you can keep your insurer status robust. Stay informed, prioritize timely maintenance, and communicate openly with your insurer to avoid disruptions in your coverage. Remember, proactive measures today safeguard your peace of mind tomorrow.