Technology is revolutionizing insurance-approved repairs through advanced digital platforms that streamline claims management, damage assessment, and communication between insurers and repair shops. These tools enhance accuracy, reduce paperwork, and speed up turnaround times with features like 3D imaging, virtual reality, and AI-driven assessments. Modernization efforts ensure efficient, transparent, and high-standard auto maintenance services, benefiting both insurance companies and policyholders.

Technology is revolutionizing the landscape of insurance-approved repairs, offering streamlined processes and enhanced quality. This article explores how digital innovations are transforming traditional repair operations, ensuring efficiency, accuracy, and an improved customer experience.

From digital documentation and real-time communication to advanced diagnostic tools and online claim management, these technological advancements are the game changers in the insurance-approved repair sector. Get ready to dive into the future of repairs!

- The Role of Technology in Streamlining Insurance-Approved Repair Processes

- – Digital documentation and data management

- – Real-time communication and collaboration

The Role of Technology in Streamlining Insurance-Approved Repair Processes

Technology plays a pivotal role in modernizing and streamlining insurance-approved repair processes. With advanced digital platforms, insurers and repair shops can efficiently manage claims, assess damages, and communicate updates in real-time. This seamless integration enhances accuracy and reduces paperwork, enabling faster turnaround times for repairs.

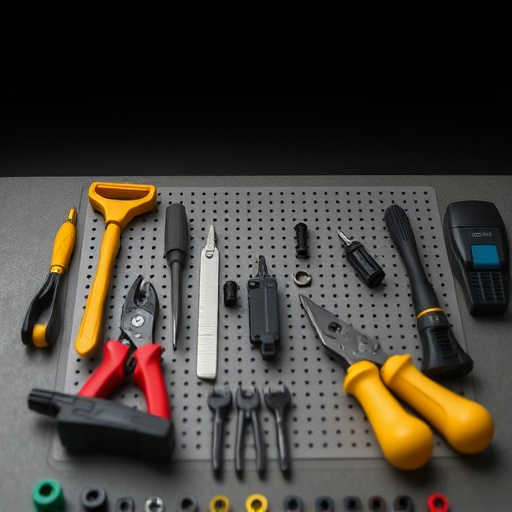

Moreover, innovative tools like 3D imaging, virtual reality, and AI-driven damage assessment provide precise measurements and visual representations of collision repair needs. These technologies facilitate accurate insurance approvals, ensuring that only authorized and necessary auto body repair or auto detailing work is undertaken, ultimately safeguarding both customers and insurers from fraudulent claims.

– Digital documentation and data management

In today’s digital era, insurance-approved repair operations have significantly evolved due to technology. One of the most notable advancements is in digital documentation and data management. Auto maintenance and collision repair shops are now equipped with state-of-the-art software that allows for efficient tracking and storage of vehicle history, repair records, and warranty information. This ensures that every step of the car repair services is documented accurately, providing a transparent record for both insurance companies and vehicle owners.

Additionally, this digital transformation streamlines the claims process, reducing paperwork and potential errors. With just a few clicks, repair shops can access previous repairs, customer consent forms, and other relevant data, enabling them to deliver timely and accurate insurance-approved repairs. This not only enhances the overall efficiency of collision repair shops but also ensures that car repair services meet the highest standards set by insurance providers.

– Real-time communication and collaboration

In today’s digital age, technology has revolutionized insurance-approved repair operations, enabling seamless real-time communication and collaboration among stakeholders. Tools like instant messaging platforms and video conferencing facilitate quick exchanges of information, ensuring that all parties involved—from insurance adjusters to repair technicians—are on the same page. This streamlined process not only accelerates the evaluation and approval of repair estimates but also enhances overall efficiency in managing claims.

For instance, advanced digital platforms allow for the sharing of detailed car scratch repair or car bodywork images and reports, enabling remote experts to provide instant feedback and approvals. This technology not only reduces paperwork but also facilitates faster turnarounds for car repair services, benefiting both insurance companies and policyholders alike.

Technology plays a pivotal role in modernizing and streamlining insurance-approved repair operations, making processes more efficient and transparent. Digital documentation and real-time communication tools enable seamless collaboration between insurers, repair shops, and policyholders, ensuring faster claim settlements and higher customer satisfaction. By leveraging these technological advancements, the industry can enhance its ability to deliver reliable and cost-effective insurance-approved repairs, fostering a more responsive and innovative ecosystem.