Before starting insurance-approved repair, understand your insurer's specific guidelines for collision repairs, classic car restorations, and other body work, using OEM parts and certified specialists to ensure compliance, coverage, and optimal vehicle care. After assessing damage, engage with your insurer for approval to prevent disputes. Review insurer criteria, complete forms accurately, and contact them to initiate claims for a smooth, approved repair process.

“Unsure when to seek insurer repair approval certification? This guide provides clarity on navigating post-claim repairs. Understanding insurance-approved repair requirements is crucial for smooth property restoration. Learn when your damaged property qualifies for coverage and how to initiate the process. From meeting essential criteria to ensuring efficient reimbursement, this article covers all aspects of certifying insurance-approved repairs, empowering you to make informed decisions.”

- Understanding Insurance-Approved Repair Requirements

- When Your Property Needs Repairs After a Claim

- Navigating the Process for Certification and Reimbursement

Understanding Insurance-Approved Repair Requirements

Before applying for insurance-approved repair certification, it’s crucial to understand the specific requirements set by your insurer. This process varies depending on whether you’re dealing with a collision repair, classic car restoration, or automotive body work. Insurers typically have detailed guidelines and standards that must be met to ensure the safety and quality of the repairs. For instance, they may mandate the use of original equipment manufacturer (OEM) parts for specific models or require certified specialists for certain complex tasks.

Familiarizing yourself with these requirements is essential as it ensures your repair work complies with insurance standards. This includes understanding the extent of coverage for repairs, deductibles, and any additional documentation needed. By adhering to these guidelines, you can streamline the approval process and guarantee that your vehicle receives the best possible care during the repair or restoration.

When Your Property Needs Repairs After a Claim

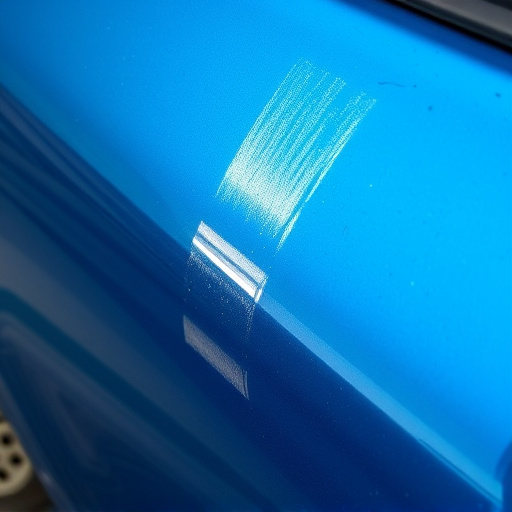

When your property, whether it’s a home or a classic car, suffers damage due to unforeseen events like accidents or weather conditions, it’s important to understand when and how to seek insurance-approved repair solutions. In the aftermath of a claim, especially after a car collision repair or dent removal, the first step is to assess the extent of the damage. If the repairs required are significant, involving structural integrity or specialized skills like classic car restoration, engaging with an insurer for approval before proceeding is crucial.

This process ensures that any work undertaken aligns with the insurance company’s guidelines and standards, preventing potential disputes later. For instance, if you’re considering a substantial repair like a complete classic car restoration, contacting your insurer to discuss the possibility of getting pre-approval can streamline the claims process. This proactive approach not only saves time but also guarantees that your efforts towards repairing or restoring your property are in line with what’s covered under your insurance policy.

Navigating the Process for Certification and Reimbursement

Navigating the process for certification and reimbursement can seem daunting, but understanding the steps involved is key to ensuring a smooth journey towards getting your insurance-approved repair. The first step is to familiarize yourself with your insurance company’s guidelines and requirements for auto glass repair, auto body repair, or car restoration. Each insurer has its own set of criteria and forms that need to be completed accurately.

Once you’ve reviewed the necessary paperwork, contact your insurance provider to initiate the claim. They will guide you through the process, including any specific forms required for insurance-approved repair certification. Providing accurate and detailed information is crucial to ensure timely approval and reimbursement.

Knowing when to apply for insurer repair approval certification is crucial for ensuring efficient property repairs after a claim. By understanding the insurance-approved repair requirements and navigating the process effectively, homeowners can streamline reimbursement and restore their properties to pre-loss condition promptly. Always remember to communicate openly with your insurance provider throughout the repair journey.